Share Post:

Write-off is often considered something of a dirty term. However, this shouldn’t really be the case, and there’s a lot more to these vehicles than meets the eye. Following this thought, today, we’re looking at whether you can buy a write-off; and, if so, what you need to know when making this important choice.

What is A Write Off Car

In the context of vehicle ownership, a write off occurs when an insurer declares a vehicle as beyond economical repair (BER) following an accident, theft, or other damage. In the UK, insurers categorize write offs into different levels based on the extent of the damage:

Category A: Scrap only, the vehicle is too damaged to be repaired and should be crushed.

Category B: The vehicle is also too damaged to be repaired, but some parts can be salvaged.

Category S (formerly Category C): The vehicle is repairable but has sustained significant damage, and the insurer has decided not to repair it due to economic reasons.

Category N (formerly Category D): The vehicle has non-structural damage, and the insurer has decided not to repair it due to economic reasons.

Can I Buy a Write-Off Car

There’s nothing to say that you can’t buy a write-off car. Write-offs will quite often be more affordable to purchase than typical vehicles, which can be a big selling point. However, they aren’t right for everyone and will inevitably come with “baggage.” As such, it’s hugely important to consider carefully whether a write-off is what you need.

Always Check a Car’s Write-Off Status Before Buying

Unfortunately, not all sellers will be honest and open about their car’s write-off status. In line with this thought, making sure you know the current situation with a vehicle before you buy is essential. Fortunately, there’s a simple way to check this: a car history check.

All you need to get started is the vehicle’s number plate; you’ll receive plenty of information about the car, such as its make, model, description, write-off and stolen status, etc. Click here for a detailed comprehensive car history check for only £9.99. This data can allow you to make a more informed decision about a second-hand purchase.

Understanding the Different Categories of Write-Offs

Whether or not you should purchase a second-hand written-off vehicle will depend on a range of factors. To inform this decision, it’s first important to understand the different types of write-off.

Not all write-offs are equal. In fact, while it sounds like a write-off should be unusable, this isn’t always the case. It simply depends on the cause of the status being applied.

Now, if you’re looking for a car to use for parts, all write-offs (except for Category A) should work. Of course, you should check that the specific part you need is still in good condition! However, if you are specifically looking for a driveable car, you’ll need to find either a category S or N.

A category S write-off is when the car is repairable, but there is significant structural damage. Meanwhile, a category N write-off occurs when there are light repairs that shouldn’t need as much work to replace.

In both cases, the cause for the write-off is generally financial viability; in other words, it’s simply not worth the insurance company paying out for the repairs. As a result, they may write the car off, but it can always be purchased back; if it is a repairable write-off, carrying out the work can get it road-worthy once again. However, if a car’s written off for scrap/breaking, no amount of repairs will get it back on the road.

Financial Impact

For vehicle owners, a write off means they will receive a settlement from their insurer based on the vehicle’s pre-accident value, minus any applicable excess. Depending on the level of damage and the vehicle’s insured value, this settlement may not fully cover the cost of replacing the vehicle.

You could potentially end up saving a good amount of money by buying a written-off car, as generally the prices are cheaper than for a non-write-off. This is because not many people want to buy a car that has been in a previous crash. However, it does not mean the car is in bad condition, as a professionally repaired car may never cause issues in the future.

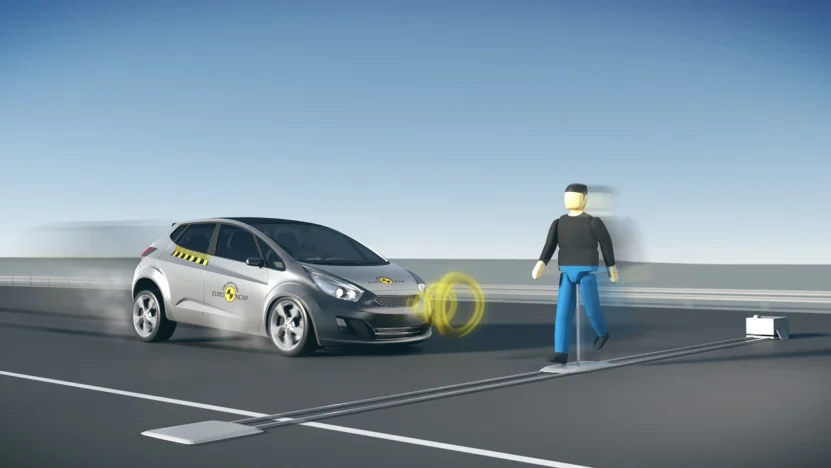

Car Safety

Sure, the price might be right, but what about safety? With written-off cars, there’s no guarantee that all the damage has been properly fixed. You could be cruising around in a car that’s not as safe as it should be. That’s a risk you don’t want to take.

Fortunately, companies like Zego offer flexible insurance solutions that can help drivers secure coverage, even for vehicles that have been classified as write-offs. With Zego, you can find affordable and flexible options tailored to your needs, whether you’re driving for personal reasons or part of a gig economy.

It’s also important to check the category of the write-off. By conducting thorough research and choosing the right insurance provider, buying a write-off can be a cost-effective option without sacrificing peace of mind.

Insurance cost

Getting insurance for a written-off car can be a bit of a nightmare. Many insurance companies aren’t keen on covering them, and if they do, you’ll probably have to pay a lot more for it. It’s something to think about before you take the plunge.

Selling Might Be Tricky

And what about when you want to sell your bargain buy? Well, you might find it’s not so easy. There’s often a stigma attached to written-off cars, which can make them harder to sell. So, that dream of making a profit might not quite pan out.

However, there are always bargain hunters out there looking to snap up a good deal. There is a buyer for every vehicle, so do not get put off by the idea that you will not be able to sell your car.

Can I Drive a Write-Off on the Road?

As we’ve previously mentioned, a written-off car needs to purchased back and repaired to a road-worthy standard. Unfortunately, this is not possible for Category A and B write-offs. These are deemed good only for scrap or parts. However, Category S and N write-offs can be repaired; keep in mind, though, that the repair bill may be more than the repaired vehicle’s actually worth.